State Government Spending in Texas

Overview

State Government Spending in Texas

Learning Objective

By the end of this section, you will be able to:

- Discuss state government spending in Texas

Introduction

This section explores in a broad sense where Texas spends its revenue.

Where Does Texas Spend its Money?

In economics and political science, fiscal policy is the use of government revenue collection (mainly taxes) and expenditure (spending) to influence the economy.

While the U.S. Government has the power to borrow money - even for operating expenses, the state government of Texas cannot. The Texas Constitution requires that Texas operate under a balanced budget. The state may only spend as much as it estimates it will receive in revenue during any fiscal biennium.

The state government in Texas has budgeted to spend $251 billion over the 2020-21 biennial budget cycle, a significant increase over the $217 billion budget for the previous two-year cycle. Lawmakers agreed to increase spending by $11.1 billion on public education and to offset mandated local property tax cuts.

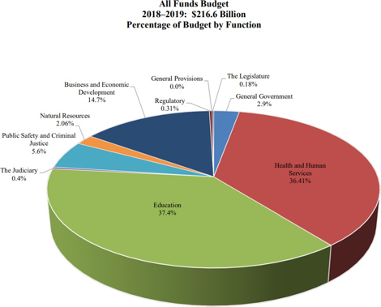

In Figure 13.2, above, note that public education is the state’s single largest spending category, followed closely by health and human services. While most of the health care portion of the budget is paid with federal funds, nearly every public education dollar must be raised locally through state taxes.

Key budget items for Texas include the foundation school program, which covers the state’s share of public K-12 education, Medicaid and Medicare, Child Protective Services, transportation, mental health, higher education criminal justice, border security, teacher retirement and health benefits, and state employee retirement.

Texas' 2020-21 budget includes significant increases in spending from the previous budget. An optimistic revenue forecast from State Comptroller Glen Hegar allowed legislators to spend 16% more than in budget approved by the House and Senate in 2017.

Much of the additional spending went to the Republican leadership's two top legislative priorities - public education and property tax reduction. The $94.5 billion allocated to education includes colleges and universities as well as K-12 public schools - an overall 10% increase in education spending from the previous budget cycle.

Meanwhile, the $84 billion appropriation for health and human services programs increased only 1% from the previous budget, with Medicaid receiving a $900 million cut - mostly in federal funding.

While governors generally use their line-item veto power to trim at least a few programs, Governor Greg Abbott approved the budget adopted by Representatives and Senators without a single line-item veto—the first time a Texas governor has approved an entire state budget since Governor Allan Shivers signed a budget without changes in 1955.

References and Further Reading

Senate Research Center (2019, January). Budget 101: A Guide to the Budget Process in Texas

Cameron, D. & Walters, E. (2019, May 31). From property taxes to teacher pay, here's how the Texas Legislature handled spending priorities. The Texas Tribune. Retrieved October 23, 2019.

Legislative Reference Library (n.d.). Legislation. Retrieved October 23, 2019.

Roldan, R. (2019, June).Texas Gov. Greg Abbott signs $250 billion budget with no line-item vetoes. The Texas Tribune. Retrieved October 23, 2019.

Licensing and Attribution

CC LICENSED CONTENT, ORIGINAL

State Government Spending in Texas. Authored by: Andrew Teas. License: CC BY: Attribution

Fiscal Policy. Authored by: Kris S. Seago. License: CC BY: Attribution