Texas' Revenue Sources

Overview

Texas' Revenue Sources

Learning Objective

By the end of this section, you will be able to:

- Identify the sources of state revenue in Texas

Introduction

This section discusses the sources of Texas' revenue.

Revenue Sources

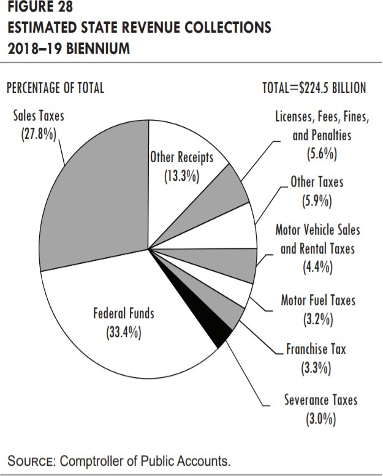

Texas is one of only seven states that do not levy a state income tax. The other 43 collect an income tax ranging from 2% in Tennessee to more than 13% in California. Accordingly, Texas has to find other ways to pay for government services.

The largest single source of revenue for state government in Texas is federal funding, which is slightly more than a third of all state revenue at $75 billion for the most recent two-year budget cycle. To put that number into perspective, Texas individuals and businesses paid $280 billion in federal income and employment taxes in Fiscal Year 2018 alone. Federal funding goes to a variety of state government functions but is used mostly to pay for healthcare programs.

The sales tax is the state’s largest source of tax revenue. The sales tax is collected by local merchants and remitted to the state – 6.25 percent of the sales price of taxable goods. Most city governments are allowed to an extra 1% to purchases within their city limits, and some transit districts, like METRO in the Houston area, can add an additional penny. Many things, such as groceries, property used in manufacturing, agricultural items, gas, electricity and water are exempt from the sales tax. Still, sales taxes brought over $62 billion into the state treasury during the most recent two-year budget cycle.

Texas levies an oil production tax at 4.6% of market value and a natural gas production tax at 7.5% of market value, minus certain deductions. These “severance taxes” combined to produce an estimated $4.9 billion during the most recent budget cycle.

An excise tax is a sales tax on a specific product or service. Texas taxes gasoline and diesel fuel at $0.20 per gallon, and charges a $0.15 per gallon equivalent on liquefied and compressed natural gas – which brought in an estimated $7.1 billion during the recent two-year budget cycle. Texas also charges excise taxes on cigarettes, cigars and tobacco that raised an estimated $2.9 billion, as well as an excise tax on alcoholic beverages that yielded an estimated $2.6 billion.

A business margins tax, still referred to officially as a “franchise tax,” brought in an estimated $3.8 billion during the recent two-year budget cycle. A complex tax that is difficult to collect, the margins tax that can be calculated in four completely different ways by Texas businesses, which can then use whichever formula results in the lowest tax. This was necessary when legislators abolished the franchise tax that had been calculated as a corporate income tax in 2007 in favor of a tax on business gross receipts. State leaders quickly found that taking a percentage of a business’ gross receipts would be much harder on a grocery store, which turns a lot of inventory on very thin margins, than a jewelry store that may only sell a few items per day, but with a significant markup. Business now have a choice of paying tax on (1) 70% of total revenue, (2) total revenue minus costs of goods sold, (3) total revenue minus total compensation and benefits or (4) total revenue minus $1 million.

An insurance premium tax brought in an estimated $5.3 billion during the most recent biennium. Insurance companies pay 1.75 % of accident, health, and life insurance gross premiums; 1.6 % of property and casualty insurance gross premiums; 1.35 % of title insurance premiums; and 4.85 % of independently procured insurance premiums.

Other taxes include a hotel occupancy tax that yielded just over $1 billion, as well as miscellaneous taxes on cement, coin-operated amusement machines and oil well service receipts that brought in a total of less than $400 million.

Non-tax revenue raised by the state includes various licenses, fees, fines and penalties that raised an estimated $12.6 billion during the most recent budget cycle. Interest and investment income yielded another $3.2 billion and the lottery netted just over $4 billion.

Land income, derived from mineral royalties and leases, grazing, land sales and sale of timber and sand raised another $2.8 billion.

References and Further Reading

Loughead, K, & Wei, E. (2019, March 20). State Individual Income Tax Rates and Brackets for 2019. Tax Foundation. Retrieved October 22, 2019.

The state of Texas (2018, September). Fiscal Size-up 2018–19 Biennium. Legislative Budget Board. Retrieved October 22, 2019.

U.S. Government Revenue. Comparison: Federal Revenue by State. Retrieved October 22, 2019.

Licensing and Attribution

CC LICENSED CONTENT, ORIGINAL

Financing State Government. Authored by: Andrew Teas. License: CC BY: Attribution