Key Policy Areas in Texas

Overview

Key Policy Areas in Texas

Learning Objectives

By the end of this section, you will be able to:

- Identify the key policy issues and challenges in Texas

Introduction

In practice, public policy consists of specific programs that provide resources to members of society, create regulations that protect U.S. citizens, and attempt to equitably fund the government. We can broadly categorize most policies based on their goals or the sector of society they affect, although many, such as food stamps, serve multiple purposes. Implementing these policies costs hundreds of billions of dollars each year, and understanding the goals of this spending and where the money goes is of vital importance to citizens and students of politics alike.

Public policy can be complicated and controversial; deciding what works best and how to allocate resources to achieve a policy goal can involve multiple trade-offs. Much of the public policy that affects citizens economically, legally and socially, is made at the state level. Highlighted here are some key policy areas in Texas.

Civil Liberties

Affirmative Action

Affirmative action refers to a complex set of policies adopted by governments and institutions to take proactive measures to increase the proportion of historically disadvantaged minority groups. These measures have taken many different forms, including strict quotas, extra outreach efforts and student financial aid specifically for minorities. In the decades since it was first instituted, affirmative action has often taken the form of racial preferences, and the two terms are often used interchangeably.

Affirmative action in Texas refers to the steps taken by employers and universities in Texas to increase the proportions of historically disadvantaged minority groups at those institutions. Historically, affirmative action nationwide has taken many different forms, such as strict quotas, extra outreach efforts, and racial and gender preferences. However, racial quotas in university admissions were banned in a 1978 United States Supreme Court case, Regents of the University of California v. Bakke.

As of March 2015, 109 out of 577 public four-year universities across the country reported that they considered race in admissions. This practice has been banned in eight states. Meanwhile, 28 states require affirmative action plans in either public employment or apprenticeships. Affirmative action programs that grant racial preferences have come under scrutiny in the courts for potentially violating the Equal Protection Clause of the Fourteenth Amendment and Title VII of the Civil Rights Act.

The Right to Bear Arms

In Texas, as in other states, public policy debates about gun violence include discussions about firearms deaths – including homicide, suicide, and unintentional deaths – as well as the impact of gun ownership, criminal and legal, on gun violence outcomes. Texans who advocate for gun control support increasing regulations related to gun ownership, whereas Texans who advocate for gun rights support decreasing regulations related to gun ownership. Gun control advocates believe that legislatures can, consistent with the Constitution, impose reasonable limits on firearms sale, ownership, and use, without raising civil liberties concerns.

The dilemma for policymakers is protecting the public while avoiding infringement on 2nd amendment rights.

The Second Amendment of the United States Constitution reads: "A well regulated Militia being necessary to the security of a free State, the right of the people to keep and bear Arms, shall not be infringed." In Texas, the right to keep and bear arms is said to belong to "every citizen" by the Texas constitution. Estimates of Texas gun ownership range from 35 to 43% of the population, which is above the national average.

At least seven people were killed and another 20 were injured in a mass shooting that stretched in and around Midland and Odessa, Texas. The incident was the second mass shooting in Texas in a month in 2019, following a shooting in El Paso, on Aug. 3.

Eight new gun laws went into effect in Texas Sept. 1, 2019, passed in May and June by the Texas Legislature (see Table 11.1). The laws eased restrictions on guns, allowing them to be carried in places of worship, during disasters and in rented and leased property.

Legislation | Law |

Allows Texans to carry guns in churches, synagogues and other places of worship, unless otherwise banned by those places with proper signage. | |

Prohibits property owners’ associations from banning storage of guns on rental properties. | |

Provides a legal defense for licensed handgun owners who unknowingly enter an establishment that bans firearms as long as they leave when asked. | |

Prohibits landlords from banning renters and their guests from carrying firearms in lease agreements.. | |

Loosens restrictions on the number of school marshals who can carry guns at public and private schools in Texas. | |

Allows Texans to carry handguns without a license during a state of disaster. | |

Prohibits school districts from banning licensed gun owners from storing guns and ammunition in their vehicles in parking lots. | |

Allows certain foster homes to store guns and ammunition in a locked location. |

Table 11.1 New Gun Laws in Effect on September 1, 2019 in Texas. Table adapted from KERA News (2019), 8 New Gun Laws Take Effect in Texas Sept 1.ws (

There are three different forms of campus carry laws that states enact: mandatory, institutional, or non- permissive. On Texas college and university campuses, mandatory "campus carry" laws became effective August 1, 2016 for 4-year universities and August 1, 2017 for community colleges. Mandatory refers to a law or court decision which requires a publicly funded institution to generally allow firearms on campus, though a few limited gun-free zones are allowed for specific sensitive places (e.g. in a secure area, or at a sporting event). In Texas, campus carry laws pertain to concealed carry only; open carry is forbidden.

Question: What is your opinion of campus carry laws in Texas? Are any areas exempted by school policy at your college or university?

Civil Rights

A bill introduced to the Texas House of Representatives in March 2015 proposed that any student who encountered another student who does not identify with their "biological sex" in a shared restroom could be awarded $2,000 in damage reparations for "mental anguish." The school itself would also be liable for failing to take action against known transgender students using their gender identified restroom.

Another bill introduced to the Texas House in February 2015 suggested that anyone over the age of 13 years found to be in a public restroom of a gender not their own should be charged with a Class A misdemeanor, spend up to a year in jail, and face a $4000 fine. Under this proposed bill, building managers who repeatedly and knowingly allow transgender individuals to use the facility of their gender identity would also face a fine of up to $10,000.

Although several bills were filed in both the regular legislative session and first special session of the Texas Legislature in 2017, in August 2017, the Texas Legislature adjourned without voting on the "transgender bathroom bill." Sponsored by State Sen. Lois Kolkhorst and championed by Lt. Governor Dan Patrick, the Texas Senate passed SB6 in the regular session and SB3 in the Special Session by a vote of 21-10 largely along party lines (Senator Eddie Lucio Jr. was the only Democrat to vote in favor of each bill). Neither bill went to the House floor for a vote (although SB6 received a hearing by the House's State Affairs committee). SB6 would have limited bathroom access based on the sex listed on one's birth certificate while SB3 would have allowed an individual to use the restroom listed on several state IDs as well (e.g. driver's license or concealed carry license).

Budget and Finances

In Texas, as in other states, lawmakers and public officials are elected in part to manage the state's finances. This includes generating revenues (money coming into the state from various sources) and approving expenditures (the money spent on governmental functions and servicing state debt). State budgets are complex and fluid, as they depend on anticipated revenues and planned expenditures, which may alter over the course of a fiscal year. If revenues do not keep pace with expenditures, states generally have to raise taxes, cut services, borrow money, or a combination of the three. State budget decisions are also influenced by policy decisions at the national level, such as the Affordable Care Act or energy and environmental regulations, and issues at the local level, such as crime and the quality of education.

Taxes

Tax policy vary from state to state. Texas, like other states, levies taxes to help fund the variety of services provided by state government. Tax collections comprise approximately 40 percent of the states' total revenues. The rest comes from non-tax sources, such as intergovernmental aid (e.g., federal funds), lottery revenues, and fees. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise (or special sales) taxes and corporate income tax.

Texas generates the bulk of its tax revenue by levying a general sales tax and select sales taxes (otherwise known as excise taxes). Property taxes keep local governments like cities, counties and school districts operating and pay for everything from police officers' salaries to classroom textbooks. The state derives its constitutional authority to tax from Article 8 of the state constitution.

Education Policy

One of the most important functions of state government is providing and funding public education. Texas has a very large and complex public school system, with an equally complex school finance system.

Three issues have played a major role in shaping education in Texas over the past fifty years: desegregation, funding equity, and finding the formula for educational excellence.

K-12 Public Education

The Texas public school system (prekindergarten through grade 12) operates within districts governed by locally elected school boards and superintendents.

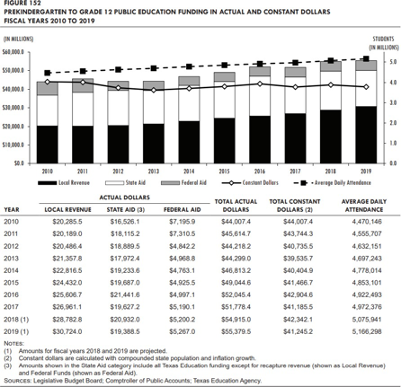

In 2018, $52.3 billion in state and local money went to 5.4 million students in 1,019 traditional school districts and 171 charter districts.

The state of Texas guarantees every school district a certain amount of funding for each student, called the basic allotment. State lawmakers determine the base number per student, which was $5,140 in 2018. Many educators argue that the state should regularly increase that base number to match the increase in inflation to provide schools with the funding they need; however, the basic allotment per student has not changed substantially since 2010.

Higher Education

Texas' higher education system is composed of 268 colleges and universities. Of these, 107 are public institutions, 73 are nonprofit private schools, and 88 are for-profit private institutions.

Other highlights:

- At public four-year colleges in Texas, 27.6 percent graduated within four years, while 51.7 percent graduated within six-years

- Hispanic students comprised approximately 34.0 percent of the total postsecondary student population in Texas

- Texas was one of five states in which the number of teaching and research assistants alone outnumbered full-time faculty.

School Choice

School choice programs provide alternatives to parents who do not wish to send their children to the local public schools to which they are assigned. Public school choice options include open enrollment policies, magnet schools, and charter schools. In addition, governments may provide financial assistance to parents who pursue private school options. This assistance may take the form of school vouchers, which allow public school students to attend private schools; scholarship tax credits; personal tax credits and deductions; and education savings accounts (ESAs), which allow parents to receive public funds directly for educational expenses. Proponents argue that school choice programs improve educational outcomes by expanding opportunity and access for historically disadvantaged students. In addition, advocates claim that school choice programs empower parents and improve traditional public schools through competition. Critics contend that these programs divert funds from traditional public schools, thereby generating unequal outcomes for students. In addition, some critics argue that school voucher programs wrongly direct tax dollars to religious organizations, which operate many private schools.

Other information policymakers use:

In Texas, there were 312,640 students enrolled in 1,740 private schools in fall 2013, accounting for roughly 6.13 percent of the state's total school-age population.

According to the Friedman Foundation for Educational Choice, as of June 2016, Texas provided no financial assistance (either in the form of vouchers or tax credits) to parents wishing to send their children to private schools instead of public schools.

Charter Schools

Charter schools in Texas are public schools operated independently of public school systems, either by nonprofit or for-profit organizations. Although they are largely publicly funded, charter schools are exempt from many of the requirements imposed by state and local boards of education regarding hiring and curriculum.

As public schools, charter schools cannot charge tuition or impose special entrance requirements; students are usually admitted through a lottery process if demand exceeds the number of spaces available in a school. Charter schools generally receive a percentage of the per-pupil funds from the state and local school districts for operational costs based on enrollment. In most states, charter schools do not receive funds for facilities or start-up costs; therefore, they must rely to some extent on private donations. The federal government also provides revenues through special grants.

Other information policymakers use:

- According to the National Alliance for Public Charter Schools, a charter school advocacy group, there were an estimated 723 total charter schools in Texas in the 2015-2016 school year. These schools enrolled approximately 282,900 students.

- Overall, charter school students accounted for 5.39 percent of total public school enrollment in Texas in 2015.

- The Texas State Legislature approved the state's charter school law in 1995.

Election Policy

Ballot Access Requirements

In order to get on the ballot in Texas, a candidate for state or federal office must meet a variety of state- specific filing requirements and deadlines. These regulations, known as ballot access laws, determine whether a candidate or party will appear on an election ballot. These laws are set at the state level. A candidate must prepare to meet ballot access requirements well in advance of primaries, caucuses, and the general election.

There are three basic methods by which an individual may become a candidate for office in a state.

- An individual can seek the nomination of a state-recognized political party.

- An individual can run as an independent. Independent candidates often must petition in order to have their names printed on the general election ballot.

- An individual can run as a write-in candidate.

Redistricting

Redistricting is the process by which new congressional and state legislative district boundaries are drawn. Each of Texas' 36 United States Representatives and 181 state legislators are elected from political divisions called districts. United States Senators are not elected by districts, but by the states at large. District lines are redrawn every 10 years following completion of the United States census. The federal government stipulates that districts must have nearly equal populations and must not discriminate on the basis of race or ethnicity.

Other information policymakers may use:

- Following the 2010 United States Census, Texas was apportioned 36 congressional seats. Texas' House of Representatives is made up of 150 districts; Texas' State Senate is made up of 31 districts.

- In Texas, congressional and state legislative district boundaries are drawn by the state legislature. If the legislature fails to approve a state legislative redistricting plan, a backup commission must draw the lines.

- Texas' congressional and state legislative district maps that were drawn after the 2010 census have been subject to litigation (https://ballotpedia.org/Redistricting_in_Texas#Redistricting_after_the_2010_census). On June 25, 2018, the Supreme Court of the United States reversed a district court decision striking down several congressional and state legislative district maps as unconstitutional racial gerrymanders (the high court upheld the district court's finding of racial gerrymandering with respect to one state House district).

Energy Policy

Energy policy involves governmental actions affecting the production, distribution, and consumption of energy in a state. Energy policies are enacted and enforced at the local, state, and federal levels and may change over time. These policies include legislation, regulation, taxes, incentives for energy production or use, standards for energy efficiency, and more. Stakeholders include citizens, politicians, environmental groups, industry groups, and think tanks. A variety of factors can affect the feasibility of federal and state-level energy policies, such as available natural resources, geography, and consumer needs.

Fracking

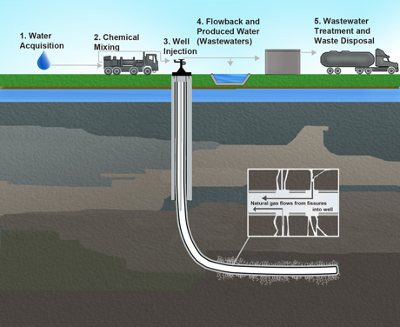

Hydraulic fracturing, also known as fracking, is a method of oil and natural gas extraction that involves injecting fluid into subterranean rock formations at high pressure. The Oil and Gas Division within the Texas Railroad Commission is responsible for regulating fracking in Texas.

Texas overlies portions of the Anadarko Basin, the Palo Duro Basin, the Permian Basin, the Barnett Shale, the Eagle Ford Shale, and the Haynesville-Bossier Shale. As of February 2017, Texas had 279,615 active oil and gas wells. As of May 2017, however, the state did not track the number of wells that were hydraulically fractured. According to the Texas Railroad Commission, fracking began in Texas in the 1950s.

While states have primary regulatory authority over fracking, oil and gas operators must meet requirements in the following federal environmental and public health laws, among others:

- The Clean Air Act (https://www.epa.gov/clean-air-act-overview), which regulates air pollutants emitted during oil and gas production

- The Clean Water Act (https://www.epa.gov/laws-regulations/summary-clean-water-act), which regulates all pollution discharges into surface waters and requires oil and gas operators to obtain permits to discharge produced water—fluids used during fracking as well as water that occurs naturally in oil or gas-bearing formations—into surface water.

- The Comprehensive Environmental Response, Compensation and Liability Act (CERCLA), (https://www.epa.gov/laws-regulations/summary-comprehensive-environmental-response- compensation-and-liability-act)which requires oil and gas operators to report the release of hazardous substances during oil and operations and allows the EPA to investigate hazardous substance releases and require operators to restore areas affected by hazardous spills.

As of March 2017, Texas regulations required fracking operators to complete and submit a list of chemicals used during the fracking process on the website FracFocus.org. Operators that consider a chemical or the concentration of a chemical to be a trade secret are allowed to withhold these chemicals from public disclosure and thus disclosure to potential competitors.

Environmental Policy

Environmental policy aims to conserve natural resources by balancing environmental protection with economic growth, property rights, public health, and energy production. This is done mainly through laws and regulation passed at all governmental levels and influenced by many stakeholders with different agendas.

Endangered Species

Endangered species policy in Texas involves the identification and protection of endangered and threatened animal and plant species. Policies are implemented and enforced by both the state and federal governments.

Finance Policy

The United States financial system is a network that facilitates exchanges between lenders and borrowers. The system, which includes banks and investment firms, is the base for all economic activity in the nation. According to the Federal Reserve, financial regulation has two main intended purposes: to ensure the safety and soundness of the financial system and to provide and enforce rules that aim to protect consumers. The regulatory framework varies across industries, with different regulations applying to different financial services. Individual federal and state entities have different and sometimes overlapping responsibilities within the regulatory system. For example, individual states and three federal agencies—the Federal Reserve, the Office of Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC)— regulate commercial banks. Other sectors of the financial market are regulated by specific entities. The Department of Banking is the primary regulatory body for financial institutions in Texas. Some, such as the Brookings Institution, argue that expanded governmental regulation of banks and financial products (e.g., mortgages) can prevent large- scale financial crises, protect consumers from abusive practices, and stabilize financial markets. Others, such as the Cato Institute, argue that over-regulation of banks of banks and financial products burdens business, stalls economic growth, and does little, if anything, to stabilize financial markets. Beyond this basic debate about the role of the government in regulating the private financial sector, there are varying opinions about the proper extent of governmental regulation.

Healthcare Policy

Healthcare policy in Texas involves the creation and implementation of laws, rules, and regulations for managing the state's healthcare system. The healthcare system consists of services provided by medical professionals to diagnose, treat, and prevent mental and physical illness and injury. The system also encompasses a wide range of related sectors, such as insurance, pharmaceuticals and health information technology.

Healthcare policy affects not only the cost citizens must pay for care, but also their access to care and the quality of care received, which can influence their overall health. A top concern for policymakers is the rising cost of healthcare, which has placed an increasing strain on the disposable income of consumers as well as on state budgets.

Other issues in healthcare policy include

- state Medicaid expansion,

- health information technology and privacy,

- uninsured and underinsured portions of the population, a shortage of primary care physicians, and

- mental healthcare access and coverage.

One long-term policy issue has been how to provide for the basic needs of poor people in Texas. Social welfare policy is designed to ensure some level of equity in a democratic political system based on competitive, free-market economics. During the Great Depression, many politicians came to fear that the high unemployment and low-income levels plaguing society could threaten the stability of democracy, as was happening in European countries like Germany and Italy. The assumption in this thinking is that democratic systems work best when poverty is minimized.

Social welfare policy creates an automatic stimulus for society by building a safety net that can catch members of society who are suffering economic hardship through no fault of their own. For an individual family, this safety net makes the difference between eating and starving; for an entire economy, it could prevent an economic recession from sliding into a broader and more damaging depression.

Poverty is a complicated policy issue in Texas. There are more than 200 programs administered by the Texas Health and Human Services Commission (HHS) that are aimed at different problems related to poverty.

As part of a broader social welfare policy in Texas, Medicare and Medicaid were intended to ensure that vulnerable populations have access to health care. Medicare is an entitlement program funded through payroll taxes. Its purpose is to make sure that senior citizens and retirees have access to low-cost health care they might not otherwise have, because most U.S. citizens get their health insurance through their employers.

Medicare provides three major forms of coverage: a guaranteed insurance benefit that helps cover major hospitalization, fee-based supplemental coverage that retirees can use to lower costs for doctor visits and other health expenses, and a prescription drug benefit. Medicare faces the problem that health care costs are rising significantly faster than inflation.

Medicaid Spending

Medicaid is a formula-based health insurance program, which means beneficiaries must demonstrate they fall within a particular income category. Individuals in the Medicaid program receive a fairly comprehensive set of health benefits, although access to health care may be limited because fewer providers accept payments from the program (it pays them less for services than does Medicare).

Medicaid differs dramatically from Medicare in that it is partially funded by states, many of which have reduced access to the program by setting the income threshold so low that few people qualify. The ACA (2010) sought to change that by providing more federal money to the states if they agreed to raise minimum income requirements. Many states have refused, which has helped to keep the overall costs of Medicaid lower, even though it has also left many people without health coverage they might receive if they lived elsewhere.

Texas' Medicaid program provides medical insurance to groups of low-income people and individuals with disabilities. Medicaid is a nationwide program jointly funded by the federal government and the states. Medicaid eligibility, benefits, and administration are managed by the states within federal guidelines. A program related to Medicaid is the Children's Health Insurance Program (CHIP), which covers low-income children above the poverty line and is administered like Medicaid through the Centers for Medicare and Medicaid Services in the U.S. Department of Health and Human Services.

TexCare offers additional children's health insurance programs through Medicaid, which is provided at no cost to qualifying children, and the State Kids Insurance Program (SKIP). State employees may qualify for an insurance supplement for dependent children under age 19. SKIP supplements are covered through the Texas state insurance program.

Effect of the Affordable Care Act

The impact of the Affordable Care Act of 2010 (ACA), also known as Obamacare, has been debated among politicians, policymakers, and other stakeholders. The ACA was signed into law in 2010 by President Barack Obama (D). The law facilitates the purchase of health insurance through a system of health insurance exchanges, tax credits, and subsidies. Initially, states were required to expand eligibility for Medicaid under the law; a 2012 ruling by the United States Supreme Court made the Medicaid expansion voluntary for states. The law also requires insurers to cover healthcare services within a standard set of benefits and prohibits coverage denials based on preexisting conditions. Under the law, all individuals are required to obtain health insurance.

Immigration Policy

Immigration policy determines who may become a new citizen of the United States or enter the country as a temporary worker, student, refugee, or permanent resident. The federal government is responsible for setting and enforcing most immigration policy. Meanwhile, states assume a largely supportive role, enacting their own supplementary laws and setting policies that may, for example, determine which public services immigrants can access, establish employee screening requirements, or guide the interaction between related state agencies and their federal counterparts.

Many groups seek to determine the economic costs and benefits that immigration brings to states and the United States as a whole. Some groups estimate that immigrants are a net gain to the economy because of the goods and services they provide while others claim that immigrants impose a net burden to the state by using healthcare, education, or welfare services.

Some jurisdictions, including some states, cities, and counties, have adopted policies of not cooperating with federal immigration enforcement; these jurisdictions have become known as sanctuary jurisdictions.

References and Further Reading

Regents of the University of California v. Bakke. (n.d.). Oyez. Retrieved October 23, 2019,

Harris, D. N. (2009). Affirmative Action: Race or Class? Miller Center of Public Affairs.

Strasser, Mr. Ryan (2008-07-01). "Second Amendment.” LII / Legal Information Institute.

Igielnik, R. & Brown, A. (2017). Key Takeaways on Americans' Views of Guns and Gun Ownership. Pew Research Center. Retrieved October 22, 2019.

KERA (2019, September 1). 8 New Gun Laws Take Effect in Texas Sept. 1. Retrieved October 22, 2019.

Mellig, L. (2018, March 26). The ACLU's Position on Gun Control. American Civil Liberties Union.

Texas Legislature (2015). H.B. No. 280. Retrieved October 22, 2019.

Kellaway, M. (2015). "Texas Bill Would Jail Those Whose Chromosomes Don't Match the Restroom They're Using.” Advocate.

Texas Legislature (2015). H.B. 1748. Retrieved October 23, 2019.

McGaughy, L. (2017, March 15). Bathroom of 'biological sex' bill passes Texas Senate. Dallas Morning News.

Ura, A. (2017, July 25). Texas Senate Votes Again To Advance 'Bathroom Bill. The Texas Tribune.

Brunori, D. (2011). State Tax Policy: A Political Perspective. Washington, D.C.: The Urban Institute Press. Retrieved October 22, 2019.

Texas Constitution and Statutes, Texas Constitution: Article VIII Taxation and Revenue. Retrieved October 22, 2019.

Swaby, A. (2019). Texas School Finance System is Unpopular and complex. Here's How it Works. Texas Tribune. Retrieved October 23, 2019.

National Center for Education Statistics (2016). College Navigator - Texas.

Friedman Foundation for School Choice (n.d.). What is School Choice?

Professor Justin Levitt's Guide to Drawing the Electoral Lines (2019). All About Redistricting: Why Does it Matter? Retrieved October 23, 2019.

Schwartz, J. (2011, June 29). Cracked, stacked and packed: Initial redistricting maps met with skepticism and dismay. Indy Week.

Hill, S. (2013, June 17). How the Voting Rights Act Hurts Democrats and Minorities. The Atlantic.

Texas Commission on Environmental Quality (2019, June 27). Barnett Shale Maps and Charts. Retrieved October 23, 2019.

Texas Railroad Commission (2017). Oil Well Counts by County. Retrieved October 23, 2019.

Texas Railroad Commission (2017). Gas Well Counts by County. Retrieved October 23, 2019.

Texas Railroad Commission (2018). Hydraulic Fracturing. Retrieved October 23, 2019.

Chemical and Engineering News, "Tracking Fracking.” Retrieved October 23, 2019.

The National Bureau of Economic Research (2011). A Brief History of Regulations Regarding Financial Markets in the United States: 1789 to 2009. Retrieved October 23, 2019.

Federal Deposit Insurance Corporation (2011). The U.S. Federal Financial Regulatory System: Restructuring Federal Bank Regulation Retrieved October 23, 2019.

Baily, M. N., Johnson, M. S. & Litan, R. E. (2008, November 24). The Origins of the Financial Crisis (https://www.brookings.edu/research/the-origins-of-the-financial- crisis/). Brookings. Retrieved October 23, 2019.

The Cato Institute (2009, July 31). Did Deregulation Cause the Financial Crisis? Retrieved October 23, 2019.

Benefits.gov (2019). TexCare Children's Health Insurance Program (CHIP). Retrieved October 23, 2019.

Licensing and Attribution

CC LICENSED CONTENT, ORIGINAL

Public Policy in Texas. Authored by: Ballotpedia. License: GNU Free Documentation License

Bathroom Bill: Texas. Authored by: Wikipedia. License: CC BY-SA

Bathroom Bill: Texas. Authored by: Wikipedia. License: CC BY-SA

CC LICENSED CONTENT, ADAPTATION

The Right to Bear Arms. Adapted from Gun Politics in the United States and Campus Carry in the United States. Authored by: Wikipedia. License: CC BY-SA

Fracking. Adapted from Fracking in Texas. Authored by Ballotpedia. License: GNU Free Documentation License