County Governments in Texas

Overview

County Governments in Texas

Learning Objective

By the end of this section, you will be able to:

- Explain the structure and function of county government in Texas

Introduction

This section discusses the structure and function of Texas' 254 county governments.

County Governments in Texas

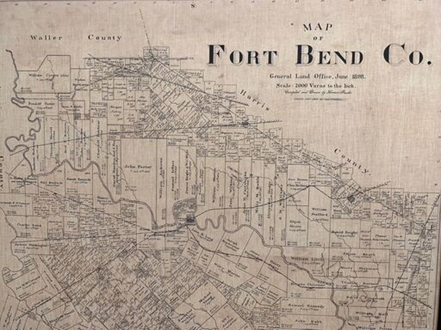

Texas has a total of 254 counties, by far the largest number of counties of any state. Under Spanish and, later, Mexican rule, Texas was divided into municipios, which, despite sharing a name origin with municipalities, were more like the counties of today – large districts containing one or more settlements and the surrounding rural land.

When Texas became a Republic in 1836, the 23 municipios became counties, with a structure that changed only slightly before, during, and after the Civil War. By 1870, Texas had 129 counties, and the Constitution of 1876, still in place today, went into significant detail about their formation and operation.

Image Credit: Andrew Teas, Licsense: CC BY

The last new county to be established was Loving County in 1931. More on Loving County later…

The structure of county government in Texas is defined in the Constitution, so it’s not surprising that the form closely follows the plural-executive model of state government.

Image Credit: Andrew Teas, License: CC BY

Each Texas county is run in part by a five-member commissioners’ court consisting of a county judge, elected at-large, and four county commissioners elected from each of four precincts. Many county functions are run by independently elected officials, who answer directly to the voters, rather than to commissioners’ court. While county commissioners have authority over each official’s budget, they have little to say about the day-to-day administration of county offices. In most counties, these independently-elected officials include the county sheriff, the county attorney, the district attorney, the county clerk, the district clerk, the county treasurer, and the county tax assessor-collector as well as a number of judges that varies widely with the population of the county.

County Judge

While a county judge, particularly in rural counties, does have a judicial function, a county judge in Texas is primarily the chair of the county commissioners' court. He also plays an important role as head of the county's emergency management functions.

County Commissioner

County commissioners in Texas are incredibly powerful, especially in large counties. Not only do they vote on countywide issues as part of commissioners' court, they have almost unliateral control over the planning and constructions of roads, bridges and parks within their precinct, which is one-fourth of the county (by population).

County Sheriff

The sheriff is the county's chief law enforcement officer. He also manages the county jail and provides security for the county courts.

County Attorney

The County Attorney is the county's lawyer, providing legal advice and representing the county and its officials in all civil cases. This can present an interesting dilemma, since county officials are all independently elected. Sometimes a county official and the lawyer official representing him may be political opponents. The county attorney also pursues civil enforcement actions on behalf of the county.

District Attorney

The district attorney is the state's prosecutor, representing the government in criminal cases in that county's state district courts.

County Clerk

The county clerk is the county's custodian of records and documents, in charge of public records such as bonds, birth and death certificates, marriage licenses. The county clerk is also the chief election officer in most counties, administering elections and counting the votes.

District Clerk

The district clerk is the recordkeeper for all records pertaining to the state district courts in that county. He coordinates the jury selection process and manages court registry funds.

County Treasurer

The county treasurer is the county's banker - receiving and depositing all county revenues, preparing the county payroll ad recording all county expenditures and receipts.

County Tax Assessor-Collector

Part of the county tax assessor-collector title is somewhat misleading - all tax "assessment" is now done by appraisal districts. The "collector" part still applies, however. In addition to collecting all county property taxes, the county tax assessor-collector usually collects property taxes for other taxing jurisdictions within the county, such as school districts and cities. He also issues license plates and registration stickers, and handles voter registration.

County officials are elected in partisan elections, and commissioner precincts are redrawn every ten years following the census to roughly equalize the population of each. Unlike other states, Texas does not allow for consolidated city-county governments. Cities and counties (as well as other political entities) are permitted to enter “interlocal agreements” to share services (for instance, a city and a school district may enter into agreements with the county whereby the county bills for and collects property taxes for the city and school district; thus, only one tax bill is sent instead of three). Texas does allow municipalities to merge, but populous Harris County, Texas consolidating with its primary city, Houston, Texas, to form the nation’s second-largest city (after New York City) is not a prospect under current law.

Unlike cities, which can receive sales tax revenue, counties are funded almost entirely with property taxes. Counties in Texas are general-law units of government, with limited regulatory powers. In most counties, this doesn’t present a major problem. Populated areas are generally incorporated as cities, which have more extensive regulatory authority. Unincorporated areas – those areas outside the city limits of any city – have historically been rural areas with less need for regulation. Harris County, however, has become an important exception. Harris County’s population is nearly 5 million people as of 2019, with more than 2 million in the unincorporated area. If the unincorporated part of Harris County were a city, it would be the fifth-largest city in the United States. Fourteen states have fewer residents than the unincorporated part of Harris County, which has no building code and limited land use regulation.

Meanwhile, in West Texas, Loving County has the exact same governance structure to administer a county with an estimated population of 152 – from which voters must choose at least a dozen elected county officials.

Harris County sums up some of its challenges in its annual budget report:

Harris County government provides services to all of the residents of the county. Most of the higher cost county functions including the courts system, Hospital District, county jail, and most of the county administrative functions are located within the City of Houston. County government is the primary provider of roads, parks, facilities, and law enforcement for the unincorporated areas.

Harris County funds the county-wide and unincorporated area services primarily with property tax revenue. Despite the significant size and population of the unincorporated area, the county does not receive sales tax revenue to help fund services. The unique, ongoing challenge for Harris County government is to meet the needs of this rapidly growing unincorporated area without the funding sources provided to large cities in Texas. Most of the growth in expenditures in the County General Fund during this period has been for county-wide functions including law enforcement, the administration of justice, managing the jails, and the growing cost of indigent healthcare. As the population continues to grow, the demand for services, new roads, and expanded facilities in the unincorporated areas of the county will increase.

Texas counties are prone to inefficient operations and are vulnerable to corruption, for several reasons. First, most of them do not have a merit system but operate on a spoils system, so that many county employees obtain their positions through loyalty to a particular political party and commissioner rather than whether they actually have the skills and experience appropriate to their positions. Second, most counties have not centralized purchasing into a single procurement department which would be able to seek quantity discounts and carefully scrutinize bids and contract awards for unusual patterns. Third, in 90 percent of Texas counties, each commissioner is individually responsible for planning and executing their own road construction and maintenance program for their own precinct, which can result in poor coordination and duplicate construction machinery.

Licenses and Attributions

CC LICENSED CONTENT, ORIGINAL

County Government in Texas. Authored by: Andrew Teas. License: CC BY: Attribution